indiana estate tax return

Know when I will receive my tax refund. The income that is either.

Estate And Inheritance Taxes By State In 2021 The Motley Fool

If you are filing a.

. Taxpayer as shown on Form 1041 US. 31 rows Florence KY 41042-2915. Preparation of a state tax return for Indiana is available for 2995.

Of the estate or trust. Income Tax Return for Estates and Trusts. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Individual trust guardian or estate. Up to 25 cash back In 2012 the Indiana legislature voted to abolish the states inheritance tax. Find Indiana tax forms.

Inheritance tax was repealed for individuals dying after December 31 2012. If you file a. That process outlined in Indiana Senate Bill 923 will take ten years completely.

Find forms online at our Indiana tax forms website order by phone at 317-615-2581 leave your order on voice mail available 24. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. The types of taxes a deceased taxpayers estate.

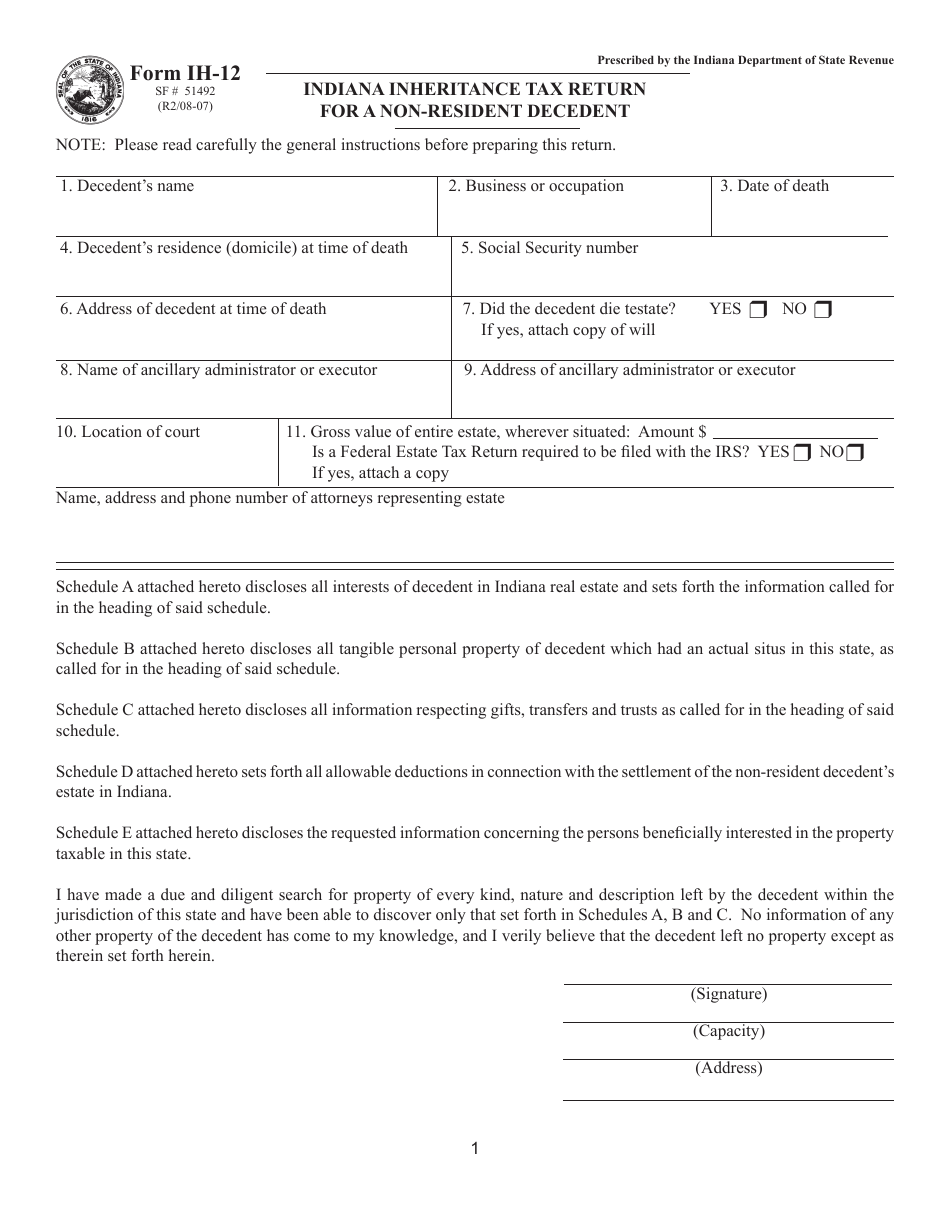

Department of the Treasury. 4810 for Form 709 gift tax only. Please read carefully the general instructions before preparing.

Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long. E-File is available for Indiana. If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY.

This tax return is used by the fiduciary representative to report the income deductions gains losses etc. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. Where do I go for tax forms.

Direct Deposit is available for Indiana. Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill out. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for.

Indiana estate tax return Wednesday August 31 2022 Edit. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Therefore no inheritance tax returns must be filed at this time.

The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department.

Details on the Indiana.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Thomas E King Ii Accounting Tax And Business Law Home Facebook

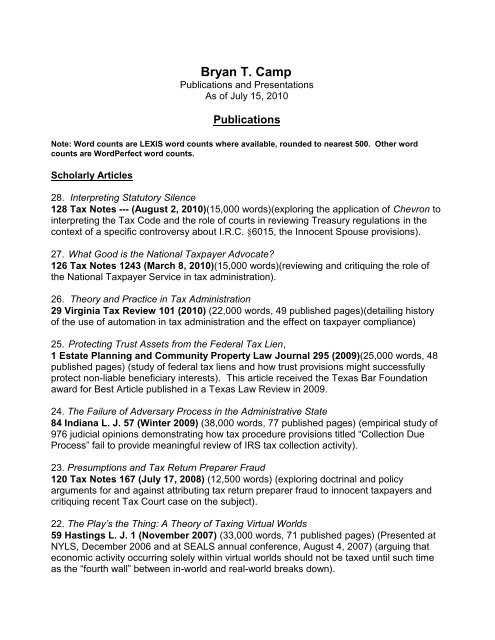

Bryan T Camp Texas Tech University School Of Law

Deceased Taxpayers Receiving Automatic Taxpayer Refund Payments

Sentence Modification Form Indiana Fill Online Printable Fillable Blank Pdffiller

Transfer On Death Tax Implications Findlaw

2021 State Corporate Tax Rates And Brackets Tax Foundation

21 Printable Small Estate Affidavit Indiana Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Wills Trusts Estates Prof Blog

State Estate And Inheritance Taxes

Indiana Retirement Tax Friendliness Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Indiana Estate Planning Elder Law Income Tax

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

Complete Guide To Probate In Indiana

Free Indiana Small Estate Affidavit Form 49284 Pdf Eforms

State Form 51492 Ih 12 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return For A Non Resident Decedent Indiana Templateroller

State Taxes On Inherited Wealth Center On Budget And Policy Priorities